Buy Now, Pay Later For Businesses

Boosted Working Capital and Flexibility

for International Payments

Buy what you need today and pay back later, 15 days after month end

Pre-approved credit lines of up to S$20,000

Sign up in <5mins, minimal documentation required

Collaborative Partnership With

Buy Now, Pay Later

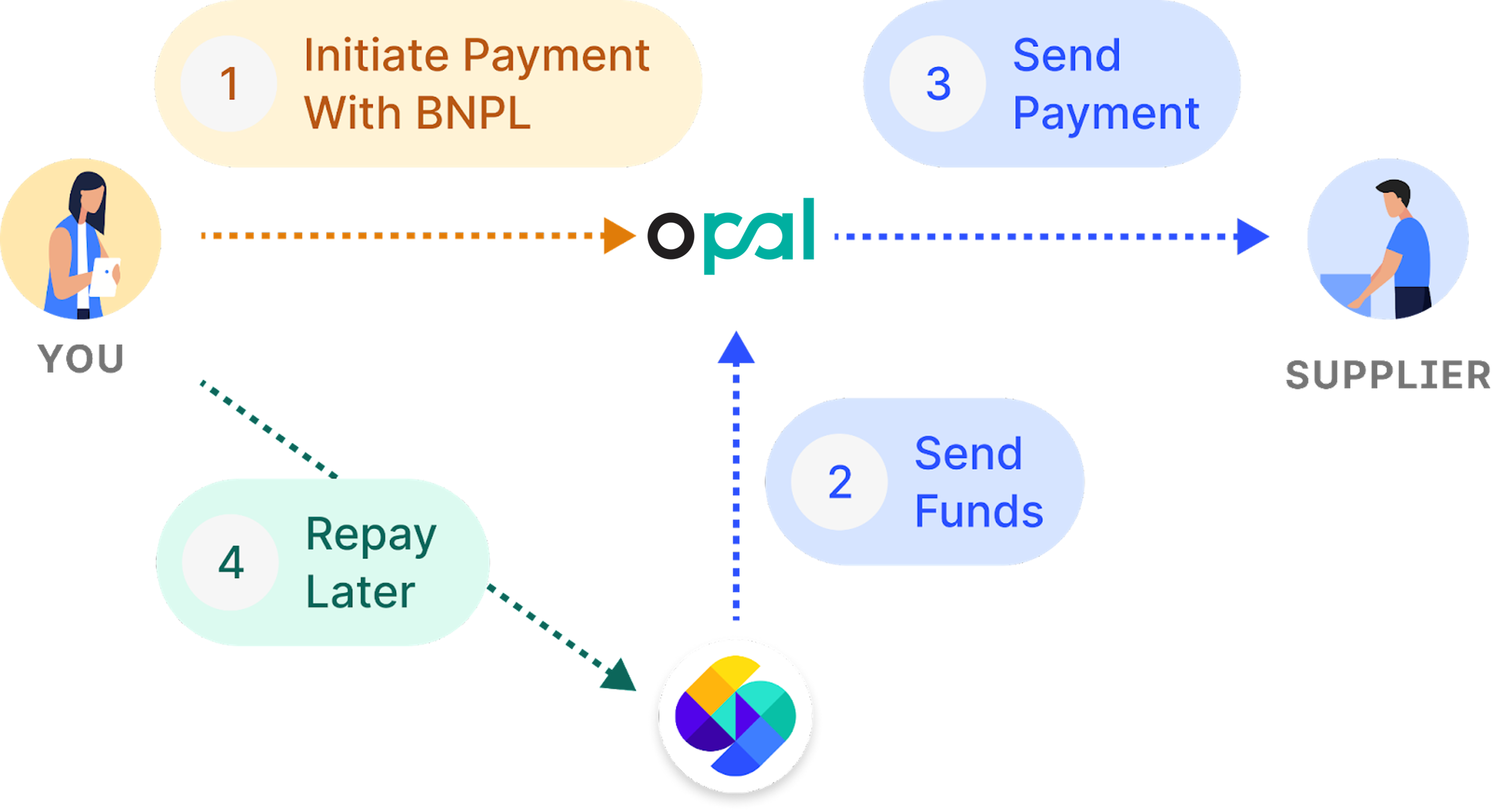

With Buy Now Pay Later and OPAL, you are able to pay your vendors and suppliers anywhere in the world.

How does it work?

1) Apply online

Fill up the application form and attach the supporting KYC documents

Simplified onboarding process

2) Make Payment

Select FS Buy Now, Pay Later at check out to tap on your approved facility and complete your order

3) Repay and continue

Make payment 15 days after receiving your bill from FS

Buy Now Pay Later Benefits

No Initial Cash Outlay

Draw on your approved facility to make immediate payments without limiting cash flow

Make payments in multiple currencies via OPAL

Pay back later, 15 days after month end allows flexibility in working capital

All-in utilisation fee

Exclusive for Opal customers only - Enjoy a promotion facility setup fee of 1% flat (U.P. 2%) of your total approved facility limit of all applications received by 31 May 2022

Only 2.00% ultilisation fee on what you used only

Application Made Simple

Pre-approved facility

Apply online by filling up the form below

Receive an approval within 48 hours

Am I eligible for Buy Now Pay Later?

Singapore registered business

Minimum 30% shareholding by a Singaporean Citizen or Permanent Resident Director

Access Buy Now Pay Later Now

Frequently Asked Questions

Through a collaboration between Funding Societies and Opal, Opal Users can now make payments to their overseas vendors/suppliers globally in 34 different currencies (i.e. Buy Now) while making repayment at a later date (i.e. pay later).

This is only eligible for payments for goods and services to third party vendors/suppliers.

With BNPL, you can access a pre-approved credit line for use anytime without any collateral. Furthermore, this can be a cheaper alternative compared to your credit cards or personal loans.

Application

You will need to submit the form with your NRIC and latest three months bank statements for our KYC check and final approval.

Upon receiving the full set of documents, you will receive the approval notice within 3 business days from Funding Societies.

Upon receiving the full set of documents, you will receive the approval between 1 to 4 business days from Opal.

Yes. After your BNPL facility is approved by Funding Societies, you will need to complete an onboarding process to create your Global Digital Business Account with Opal in order to utilise your facility.

There is a token upfront annual facility fee of 2% based on the approved facility limit (e.g. 2% * $20k = $400)

Usage

Upon approval of your payment transaction, Funding Societies will disburse the funds to your Global Digital Business Account with Opal and pay directly to the overseas vendor/supplier.

- You can inform your dedicated relationship manager at Opal about your upcoming payment and they will assist you to utilize your approved BNPL facility.

- We are building this feature and you will be able to select this as your payment option in future.

Depending on the currency and country of your supplier, it may take up to 5 business days for your overseas supplier to receive the funds.

- You will only be charged an all-in utilisation fee of 2% flat for whatever you use.

- If you do not use it for any particular month, there is no charge.

- You will receive a bill at the end of the month, indicating the due date and total repayable amount.

Repayment

A monthly statement will be sent to you by Funding Societies and you can use any bank account to make repayment to Funding Societies directly.

We encourage you to be timely with your repayment in order to build a good credit history. However, if the repayment is not received by the due date, there will be standard late fee/charges. We will provide you with more details after your application is approved.

Reach out to us at opal@fundingsocieties.com or contact your Opal relationship manager.

Product Disclosure

Credit limit is issued and powered by Funding Societies. FS Capital Pte Ltd is part of the Funding Societies Brand.

Your eligibility to apply for Financing with Funding Societies is subject to you providing Funding Societies with all the necessary documents and information to enable it to conduct the assessments, verifications and such other checks as it deems necessary and to your agreement to Funding Societies’ and Opal’s Website Terms, Terms and Conditions, and Privacy Policies.

If your Loan application is successfully funded, such Loan will be subject to the terms and conditions of the Loan Documents between yourself and Lenders.

The loans are solely fulfilled by FS Capital Pte. Ltd.

The relationship between Funding Societies and Opal is that of independent contractors and neither party has the authority to contract or legally bind the other in any way.

Nothing contained in Opal’s website or other materials shall constitute any warranty that Funding Societies will process or fund your Loan request.

Indonesia

Pendana

layanan@modalku.co.id

+62 877 3751 1114

Peminjam

info@modalku.co.id

+62 877 7873 6144

Penagihan

collection-id@modalku.co.id

Unifam Tower, Jl. Panjang Raya

Blok A3 No.1, Kedoya Utara,

Kebon Jeruk, Jakarta Barat,

DKI Jakarta, 11520, Indonesia

Singapore

info@fundingsocieties.com

General Enquiries:

+65 6221 0958

Sales Enquiries:

+65 6011 7534

108 Robinson Road

#06-01

Singapore 068900

Malaysia

info@fundingsocieties.com.my

Primary contact

+603 9212 0208

Secondary contact

+603 2202 1013

Unit 15.01 & Unit 15.02,

Level 15, Mercu 3,

KL Eco City, Jalan Bangsar,

59200 Kuala Lumpur

Thailand

SME Loan

info@fundingsocieties.co.th

+66 93 139 9721

Investment

invest@fundingsocieties.co.th

+66 62 197 8661

No. 29, Vanissa Building,

24th Floor, Room No. 2412 & 2414,

Soi Chidlom, Ploenchit Road,

Lumpini, Pathumwan,

Bangkok, 10330

Vietnam

info@fundingsocieties.vn

(+84) 28 7109 7896

The Sarus Building

67 Nguyen Thi Minh Khai

Ben Thanh Ward, District 1

Ho Chi Minh City, Vietnam

Dreamplex

174 Thai Ha Street,

Trung Liet Ward, Dong Da District,

Hanoi, Vietnam

Funding Societies is Southeast Asia's leading SME digital financing platform. We specialise in all forms of short-term financing for SMEs, funded by individual and institutional investors. We pride ourselves in speed and flexibility, offering the widest range of term loan, trade finance and micro loan products. Backed by SoftBank Ventures Asia Corp and Sequoia India, amongst many others, Funding Societies has helped to finance over S$2 billion in business loans regionally. We are dedicated to the vision of enabling SMEs through equitable financial access, ultimately making a positive impact for our societies in Southeast Asia.

Funding Societies Pte. Ltd. and FS Capital Pte. Ltd. are part of the Funding Societies Brand.

Funding Societies Pte. Ltd.

Business Registration No.: 201505169M | CMS License No.: CMS100572

FS Capital Pte. Ltd.

Business Registration No.: 201631787R

© 2023 Funding Societies Pte. Ltd. & FS Capital Pte. Ltd. All rights reserved.