SME Digital Finance and Payments Behaviours: Southeast Asia Report 2023

Welcome to this comprehensive industry report, one that unveils the intricate tapestry of lending and payments behaviours exhibited by the vibrant community of small and medium-sized enterprises (SMEs) across Southeast Asia. Delve deep into the fabric of the financial ecosystem that shapes the economic backbone of our region.

Learn about Southeast Asia's SMEs:

What they spend on

How they send and receive payments

How they secure funding

Their financing needs and insights into spending seasonality

Their overall business outlook

About The Study

We wanted to understand what kind of challenges micro, small, and medium enterprises are facing and how they’re using digital financing and payments to capture business opportunities and efficiencies.

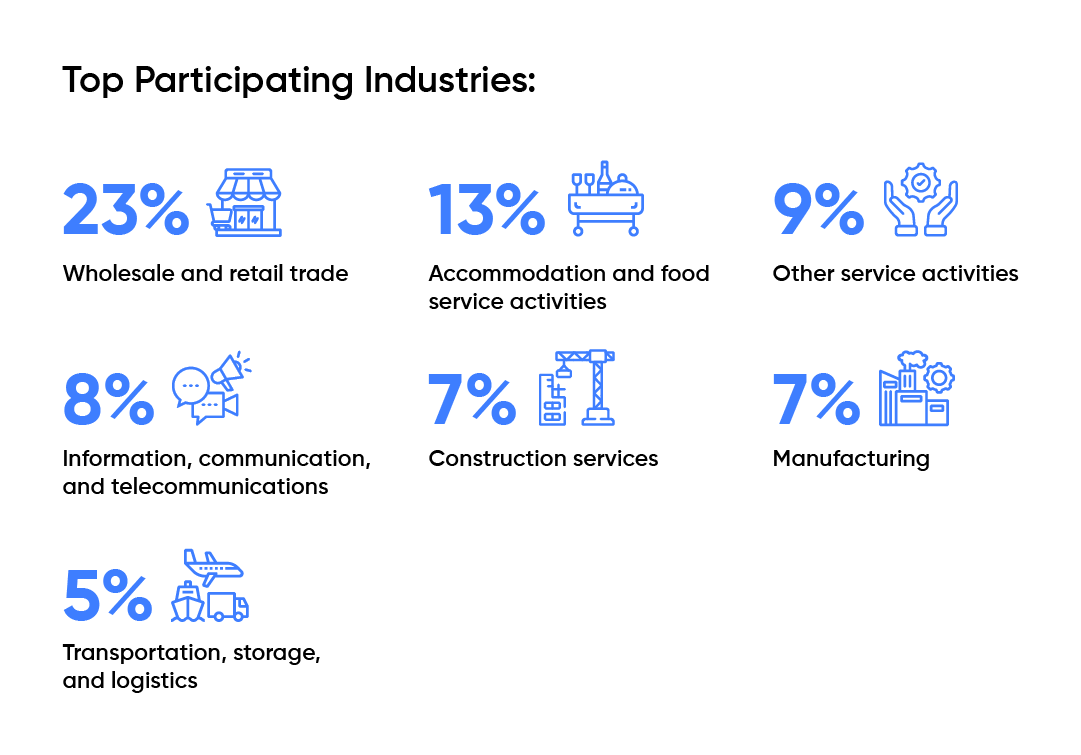

To find out, we surveyed 977 SMEs in Indonesia, Malaysia, Singapore, Vietnam, and Thailand from across several industries. Most respondents fall under the micro SME category (74%) and are the business owners themselves (63%).

Continue reading for more highlights or download the full report.

Keen, Yet Cautious: SMEs Struggle With Financial Access in Southeast Asia

Across Southeast Asia, both traditional and digital financial companies have been creating innovative products and services for small and medium enterprises (SMEs). But an abundance of choice does not necessarily lead to greater ease in accessing finance. SMEs consider different factors and tradeoffs when choosing financial solutions.

These choices can inadvertently deter financing flexibility, especially when SMEs don’t get enough information, guidance, and support in choosing products like funding schemes, SME business loans, and cloud-based software.

The results of our regional SME financing market research reflect such friction — while SMEs in Southeast Asia are actively searching for better financial products and trying out solutions offered by financial technology (FinTech) companies, many are also sticking to traditional methods like cheque payments and manual business processes.

To overcome these barriers, FinTech companies need to do more to foster trust with SMEs, facilitate better understanding of alternative financing options, and demonstrate the success of these programmes. SMEs’ piecemeal adoption of alternative finance — instead of a cohesive and systematic approach — also signals an opportunity for FinTechs to offer unified financing solutions to SMEs.

By giving SMEs the tools they need to strengthen cash flow and gain more credibility and leverage with their suppliers, financial companies can become trusted advisors that help sustain and grow SMEs, the lifeblood of the Southeast Asian economy.

The Way Forward for Southeast Asia’s SMEs: New Solutions for Old Problems

Amidst Southeast Asia’s thriving digital economy and strong mobile internet access, SMEs continue to face financial challenges and are still in the early stages of digital finance.

Our study found that cash flow remains a key SME concern, with many spending most of their funds to support daily operations and buy inventory and supplies, and worrying about paying suppliers and receiving payment from customers on time. These concerns are further aggravated by seasonal cash flow fluctuations when festive seasons increase consumer demand and raw material prices, and end-of-year objectives to complete ongoing projects and implement new ones call for an infusion of funds.

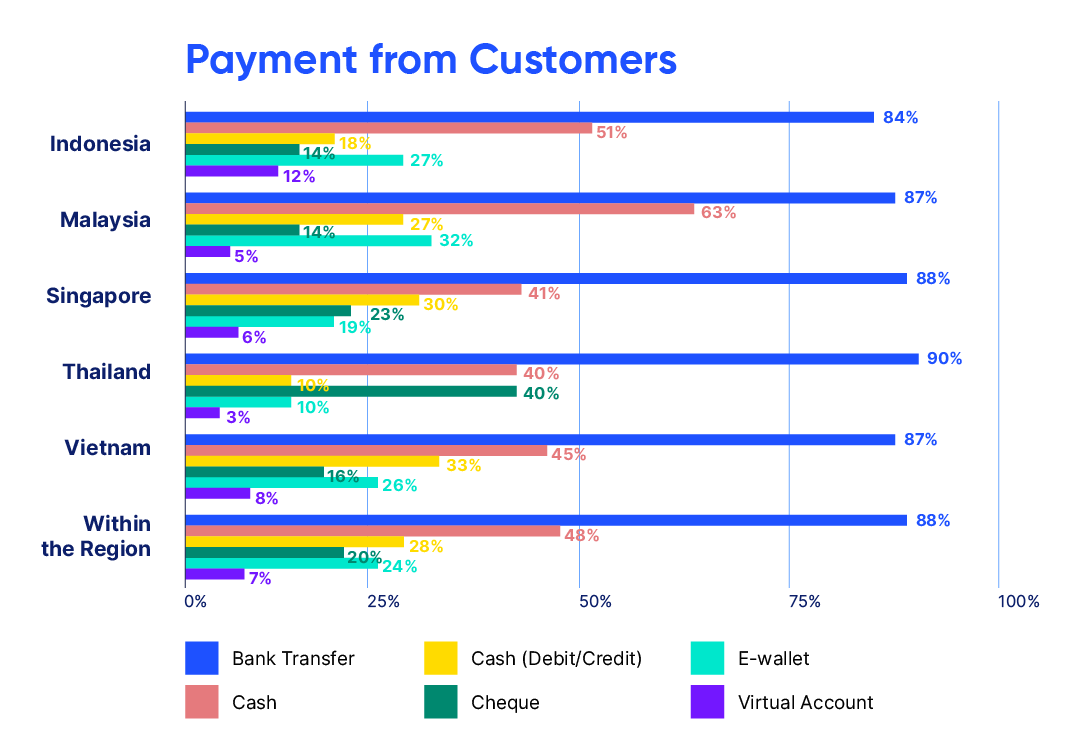

A vast majority still depend on banks to send and receive payments. Most SMEs’ transactions are also primarily local, with only a small portion doing cross-border transactions. And while many use accounting software to automate payment processes, there is a need for payment collection solutions — for both recurring, high-value transactions and mass payments — that would make the process easier and minimise late payments from customers.

Funding from traditional banking and financial institutions remains inaccessible to many, mainly due to difficult requirements and long processing times, and most SMEs have to start their business using their own savings and with help from family and friends. Additional funding typically comes from business term loans and credit card payments. Those who borrow from alternative lenders, however, are not especially brand-loyal: almost half are not highly satisfied with their current providers and are, thus, actively seeking alternatives with a smoother brand experience and lower prices.

These findings reveal a gap in the market for better financing options tailored to SMEs, ones that are more accessible than traditional financing sources and offer a low price, great brand experience, and fast approval.

SMEs’ choice of provider, however, may not boil down to primarily just cost: although most SMEs, with the exception of respondents from Indonesia, prefer low interest rates over a quick processing time, the urgent need for a healthier cash flow to support day-to-day operations and stock up on inventory means there’s space for providers that offer fast approvals.

Overall, SMEs continue to face the same cash flow-related challenges that SMEs before them have experienced. Innovative digital financing solutions, developed with Southeast Asia’s SMEs in mind, may be what the sector needs to solve these persistent old problems.

Get the Report

Recommended Reading

A harmonious working relationship with suppliers is critical for business. It helps protect your reputation, ensures the availability of essential supplies, and may even give you a leg up when negotiating for a fair price.

Asian countries like Singapore, Malaysia, Indonesia and others comprise “Altasia”, representing viable alternatives to China as production bases for cross-border manufacturers. As buyers cast wider nets across Asia, your SME can capture opportunities from this shift in the global supply chain. How can you tap on financing to do so?

Singapore joined the Regional Comprehensive Economic Partnership (RCEP) and is a part of the world’s largest free trade agreement (FTA), enjoying lower barriers to entry for goods and services throughout the Asia-Pacific region. So how can SMEs in Singapore make the most out of RCEP’s provisions to expand regionally?

Indonesia

Pemberi Dana

layanan@modalku.co.id

+62 877 7126 5290

Penerima Dana

info@modalku.co.id

+62 877 7873 6144

Unifam Tower, Jl. Panjang Raya

Blok A3 No.1, Kedoya Utara,

Kebon Jeruk, Jakarta Barat,

DKI Jakarta, 11520, Indonesia

Singapore

info@fundingsocieties.com

General Enquiries:

+65 6221 0958

Sales Enquiries:

+65 6011 7534

112 Robinson Road

Level 8

Singapore 068902

Malaysia

info@fundingsocieties.com.my

Primary contact

+603 9212 0208

Secondary contact

+603 2202 1013

Unit 15.01 & Unit 15.02,

Level 15, Mercu 3,

KL Eco City, Jalan Bangsar,

59200 Kuala Lumpur

Thailand

SME Loan

info@fundingsocieties.co.th

+66 93 139 9721

Investment

invest@fundingsocieties.co.th

+66 62 197 8661

No. 188, Spring Tower,

10th Floor, Phayathai Road,

Thung Phaya Thai Sub-district,

Ratchathewi District,

Bangkok, 10400

Vietnam

info@fundingsocieties.vn

(+84) 28 7109 7896

The Sentry P

16 Nguyen Dang Giai Street,

Thao Dien Ward, Thu Duc City,

Ho Chi Minh City, Vietnam

Dreamplex

174 Thai Ha Street,

Trung Liet Ward, Dong Da District,

Hanoi, Vietnam

Funding Societies is Southeast Asia's leading SME digital financing platform. We specialise in all forms of short-term financing for SMEs, funded by individual and institutional investors. We pride ourselves in speed and flexibility, offering the widest range of term loan, trade finance and micro loan products. Backed by SoftBank Ventures Asia Corp and Sequoia India, amongst many others, Funding Societies has helped to finance over S$2 billion in business loans regionally. We are dedicated to the vision of enabling SMEs through equitable financial access, ultimately making a positive impact for our societies in Southeast Asia.

Funding Societies Pte. Ltd. and FS Capital Pte. Ltd. are part of the Funding Societies Brand.

Funding Societies Pte. Ltd.

Business Registration No.: 201505169M | CMS License No.: CMS100572

FS Capital Pte. Ltd.

Business Registration No.: 201631787R

© 2023 Funding Societies Pte. Ltd. & FS Capital Pte. Ltd. All rights reserved.