Guaranteed Returns Investment Products

An investment option with monthly repayments

Guaranteed Returns

Balance Your Risk

Diversification

No Defaults

Guaranteed returns on your investment

Guaranteed Returns

Principal & Interests are effectively guaranteed by FS Capital Pte. Ltd. regardless of the SME's repayment status

Diversification

Diversify the risk on your investment portfolio

Balance Your Risk

Lower risk as compared to other investment products on the platform

No Defaults

Investors faced zero defaults on this product till date

How Are My Returns Guaranteed?

The guaranteed return products are offered under Funding Societies' debt investment products

Types of Guaranteed Return Products

Guaranteed Returns Investment (GRI)

Investment into a micro financing with repayments effectively guaranteed

In the case of delay or default, repayments will be made immediately irrespective of the recovery stage

Investment tenors typically between 1-6 months

Interest rates

2% - 8% p.a.

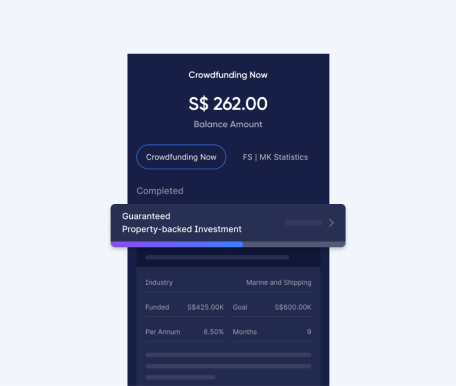

Guaranteed Property-backed Investment (GPI)

Investment into a property-backed financing with repayments effectively guaranteed

Singapore property put up as collateral against the note

In the case of default, repayment will be made within 45 days irrespective of property liquidation outcome

Investment tenors typically between 6-12 months

Interest rates

3% - 8% p.a.

Actual returns may be lower than the expected rates of return, and historical rates of returns may not reflect future returns. The Product type interest rates indicated above are derived from historical rates of returns and are exclusive of service fees

Information accurate as of 20/09/2022

Investing in 4 Steps

Diversify your portfolio by investing into a unique asset class of local SME business financing

Register For

An Account

Create an investor account in minutes and verify your email address.

Fill In

Your Information

Choose between signing up with Myinfo or fill in your information manually.

Deposit Money

Make an initial deposit of S$100 to activate your account.

Start Investing

Start participating in investment opportunities from just S$20.

Frequently Asked Questions

As our investor base grows over time, we need to continuously innovate new investment products to meet the needs of a wider range of investor profiles. We launched the Guaranteed Returns product line to cater to investors seeking a lower risk form of passive income while still enjoying a rate of return between 2% - 8% p.a.

Yes. You can do so by either manually investing into any Guaranteed Returns investment opportunities available or simply set up an Auto Invest bot that automatically invests into any of the Guaranteed Returns products.

While we're not expecting FSC to make late repayments, investors are still entitled to late repayment fees for every day of delay. In the unlikely event that FSC is unable to repay the principal and interest after 90 days past due date, the deals will be considered as default and FSC will be in default.

Yes, our standard fee of 18% of interest earned is charged.

See our growth

Check out our statistics page to get interesting insight into how we have grown and the activity on the platform.

Indonesia

Pendana

layanan@modalku.co.id

+62 877 3751 1114

Peminjam

info@modalku.co.id

+62 877 7873 6144

Penagihan

collection-id@modalku.co.id

Unifam Tower, Jl. Panjang Raya

Blok A3 No.1, Kedoya Utara,

Kebon Jeruk, Jakarta Barat,

DKI Jakarta, 11520, Indonesia

Singapore

info@fundingsocieties.com

General Enquiries:

+65 6221 0958

Sales Enquiries:

+65 6011 7534

108 Robinson Road

#06-01

Singapore 068900

Malaysia

info@fundingsocieties.com.my

Primary contact

+603 9212 0208

Secondary contact

+603 2202 1013

Unit 15.01 & Unit 15.02,

Level 15, Mercu 3,

KL Eco City, Jalan Bangsar,

59200 Kuala Lumpur

Thailand

SME Loan

info@fundingsocieties.co.th

+66 93 139 9721

Investment

invest@fundingsocieties.co.th

+66 62 197 8661

No. 29, Vanissa Building,

24th Floor, Room No. 2412 & 2414,

Soi Chidlom, Ploenchit Road,

Lumpini, Pathumwan,

Bangkok, 10330

Vietnam

info@fundingsocieties.vn

(+84) 28 7109 7896

The Sarus Building

67 Nguyen Thi Minh Khai

Ben Thanh Ward, District 1

Ho Chi Minh City, Vietnam

Dreamplex

174 Thai Ha Street,

Trung Liet Ward, Dong Da District,

Hanoi, Vietnam

Funding Societies is Southeast Asia's leading SME digital financing platform. We specialise in all forms of short-term financing for SMEs, funded by individual and institutional investors. We pride ourselves in speed and flexibility, offering the widest range of term loan, trade finance and micro loan products. Backed by SoftBank Ventures Asia Corp and Sequoia India, amongst many others, Funding Societies has helped to finance over S$2 billion in business loans regionally. We are dedicated to the vision of enabling SMEs through equitable financial access, ultimately making a positive impact for our societies in Southeast Asia.

Funding Societies Pte. Ltd. and FS Capital Pte. Ltd. are part of the Funding Societies Brand.

Funding Societies Pte. Ltd.

Business Registration No.: 201505169M | CMS License No.: CMS100572

FS Capital Pte. Ltd.

Business Registration No.: 201631787R

© 2023 Funding Societies Pte. Ltd. & FS Capital Pte. Ltd. All rights reserved.