Accounts Receivable

Financing

- Credit line up to SGD 1 million

- Financing up to 90% of the invoice value

- Tenor up to 120 day

Accounts Receivable Financing is fulfilled by FS Capital Pte Ltd

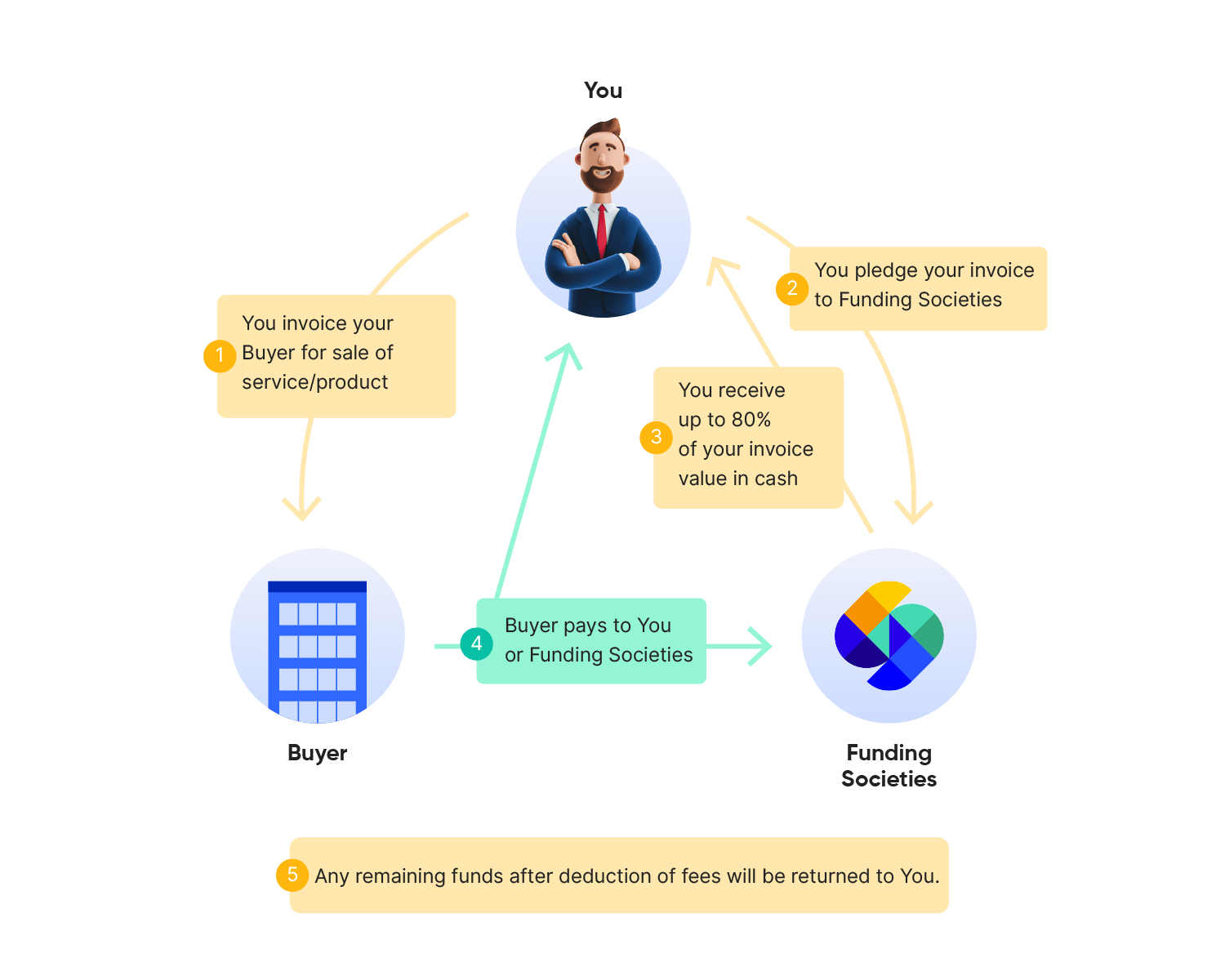

What is Accounts Receivable Financing?

Accounts Receivable Financing allows firms to receive cash earlier than the specified terms of payment through pledging invoices, as an alternative to traditional business loans. This is a financing option suitable for SMEs who have a steady stream of recurring invoices. Accounts Receivable Financing allows either notified or non-notified arrangements to suit different business requirements.

A financing solution to

boost your business cash flow

Customizable Structure

We offer invoice financing line facilities with notified and non-notified options, and are confident of having a solution suitable to your needs.

Flexible Repayment Options

We provide tenures from 30, 60, 90 to 120 days to best fit your business requirements.

Full Transparency

We will inform you of the costs and fees involved upfront, with no hidden fees for you to worry about. See our FAQs at the bottom for more information.

Quick Application

We have an online application that saves you the hassle of having to leave the comfort of home, or work.

Am I eligible for Accounts Receivable Financing?

-

Singapore registered Pte Ltd or LLP business

-

Minimum 30% shareholding by a Singapore Citizen or Permament Resident

-

6 months minimum operating history

We've got you covered

Not what you’re looking for? We have other financing solutions available to serve your needs.

.webp?width=800&height=133&name=8a3d19a2264b56f8d2d0df9a4e9387fd419bc4f38e997f0212ffe66f85c7bda6%20(1).webp)

Further Readings

Differences between Accounts Receivable (AR) and Accounts Payable (AP) Financing

Explore the differences in accounts receivable and accounts payable financing to choose the most suitable option for fulfilling your business needs and facilitating business growth. Read more today!

Enhancing Business Cash Flow through Accounts Receivable Financing

Explore the power of Accounts Receivable Financing for a successful business. Uncover the four valuable tips for SMEs to improve their cash flow and foster company growth. Read more today!

Not what you’re looking for? Check out our other SME loan offerings.

Elevate Virtual Card is offered by FS Capital Pte. Ltd. ("FSC"). Micro Loans and Term Loans is offered by both FSC and Funding Societies Pte. Ltd. ("FSPL").

Frequently asked questions

-

What is Accounts Receivable Financing?

Accounts Receivable Financing is a broad concept of financing arrangement where it allows companies to finance their early payment on their sales invoices or sales purchases, for goods delivered and/or services completed. This method of financing is ideal for businesses in need of consistent cash flow or cash upfront, especially if the majority of their transactions are on credit terms.

Fulfilled by FS Capital Pte. Ltd. -

What documents are required for my Accounts Receivable Financing application?

-

2 years financial statements, or up to date management financial statements, whichever is applicable

-

Latest 6 months bank statements

-

Director(s) and Shareholder(s) NRIC or Passport, latest 2 year NOA and CBS report

Additional documents may be required. This is determined on a case by case basis. Our team will reach out to you once your application is received.

-

-

What other financing solutions do you offer?

For additional products offerings from Funding Societies, please refer to https://fundingsocieties.com/sme-loans

Indonesia

Pemberi Dana

+62 877 7126 5290

Penerima Dana

+62 877 7873 6144

Unifam Tower, Jl. Panjang Raya

Blok A3 No.1, Kedoya Utara,

Kebon Jeruk, Jakarta Barat,

DKI Jakarta, 11520, Indonesia

Singapore

General Enquiries:

+65 6221 0958

Sales Enquiries:

+65 6011 7534

108 Robinson Road

#06-01

Singapore 068900

Malaysia

Primary contact

+603 9212 0208

Secondary contact

+603 2202 1013

Unit 15.01 & Unit 15.02,

Level 15, Mercu 3,

KL Eco City, Jalan Bangsar,

59200 Kuala Lumpur

Thailand

SME Loan

+66 93 139 9721

Investment

+66 62 197 8661

No. 188, Spring Tower,

10th Floor, Phayathai Road,

Thung Phaya Thai Sub-district,

Ratchathewi District,

Bangkok, 10400

Vietnam

(+84) 28 7109 7896

The Sarus Building

67 Nguyen Thi Minh Khai,

Ben Thanh Ward,District 1,

Ho Chi Minh City, Vietnam

Dreamplex

174 Thai Ha Street,

Trung Liet Ward,

Dong Da District,

Hanoi, Vietnam

Who we are

-

Singapore

-

Indonesia

-

Malaysia

-

Thailand

-

Vietnam

Funding Societies is Southeast Asia's leading SME digital financing platform. We specialise in all forms of short-term financing for SMEs, funded by individual and institutional investors. We pride ourselves in speed and flexibility, offering the widest range of term loan, trade finance and micro loan products. Backed by SoftBank Ventures Asia Corp and Sequoia India, amongst many others, Funding Societies has helped to finance over S$2 billion in business loans regionally. We are dedicated to the vision of enabling SMEs through equitable financial access, ultimately making a positive impact for our societies in Southeast Asia.

Funding Societies Pte. Ltd., FS Capital Pte. Ltd., FS Technologies Pte. Ltd. and CardUp Pte. Ltd. are part of the Funding Societies Brand.

Funding Societies Pte. Ltd.

Business Registration No.: 201505169M | CMS License No.: CMS100572

FS Capital Pte. Ltd.

Business Registration No.: 201631787R

FS Technologies Pte. Ltd.

Business Registration No.: 201935125G

CardUp Pte. Ltd.

Business Registration No.: 201536690R | Major Payment Institution License No.: PS20200484

© 2025 Funding Societies Pte. Ltd., FS Capital Pte. Ltd., FS Technologies Pte. Ltd. and CardUp Pte. Ltd. All rights reserved