REFERRAL AGREEMENT FOR

"SME REFERRAL PROGRAMME"

The SME Referral Programme is offered by Funding Societies. The following agreement governs your rights and obligations as a Referral Partner. By accepting the terms of the agreement to the SME Referral Programme including acceptance by electronic or digital means, you hereby consent to participate in the SME Referral Programme as a Referral Partner and acknowledge that Funding Societies may at any time amend/vary the terms of the SME Referral Programme including the terms of the agreement and also terminate any Referral Partner’s participation in the SME Referral Programme and/or the entire SME Referral Programme, at its sole discretion as it deems fit.

THIS REFERRAL AGREEMENT (“Agreement”) is made, electronically executed and agreed on the date when You, the user of the Platform, click the "Submit" button on the Platform and thereby consenting to and be bound by the terms and conditions thereon and this Agreement ("Consent Date") so as to be eligible to refer a potential Issuer/Borrower(s):

(1) You ("Referral Partner"); and

(2) FUNDING SOCIETIES PTE LTD (UEN No. 201505169M) and FS CAPITAL PTE LTD (UEN No. 201631787R), both companies duly incorporated in the Republic of Singapore, and having its registered office at 112 Robinson Road #08-01/02/03/04 Singapore 068902 (Funding Societies”)

(Each a Party and collectively the Parties).

For avoidance of doubt, Funding Societies Pte. Ltd. and FS Capital Pte. Ltd. are both part of the Funding Societies Brand wherein Funding Societies Pte Ltd is a CMS licence holder under the Securities and Futures Act (Cap. 289) for the regulated activity of dealing in capital markets products in Singapore while FS Capital Pte Ltd is an exempt moneylender under the Moneylenders Act 2008. Reference to 'Funding Societies’ anywhere in this document shall be accordingly construed to refer to the specific Funding Societies entity, as applicable.

Funding Societies reserves the right to keep and record the Consent Date and all mechanism or every technical process related to it in Funding Societies' internal system, Platform or other means of safekeeping which may be used in its sole discretion as a valid and acceptable evidence to prove the existence of the Referral Partner's unconditional and irrevocable consent and willingness to be bound by this Agreement on the Consent Date. The Referral Partner declares its consent to accept such record related to the Consent Date as a sole and legitimate evidence before any court proceedings or arbitral bodies in relation to any disputes or conflicts between Funding Societies and the Referral Partner.

IT IS AGREED AS FOLLOWS:

1. DEFINITIONS AND INTERPRETATION

1.1 In this Agreement, the following words have the following meanings:

(a) Agreement means this agreement and the accompanying schedules governing the Referral Arrangement (as may be amended and/or substituted from time to time at Funding Societies’ sole discretion).

(b) Associated Parties means directors, commissioners, employees, management, agents, representatives or proxies, subsidiaries and affiliates of the Parties.

(c) Borrowers means Leads, either individuals or entities, whom have applied for Financing from Funding Societies (specifically FS Capital Pte Ltd) and has been approved by Funding Societies (specifically FS Capital Pte Ltd) to obtain the financing subject to terms as prescribed by Funding Societies (specifically FS Capital Pte Ltd).

(d) Business Day means any day (other than a Saturday or Sunday or gazetted public holiday in Singapore) when commercial banks are open for banking business in the Republic of Singapore.

(e) Confidential Information means:

(i) this Agreement and its terms and the fact that discussions or negotiations are taking place between the Parties in connection with the subject matter of this Agreement

(ii) information about the Parties which is by its nature confidential or which is marked by each Party as confidential;

(iii) information about the Parties which either Party know or have reason to know or believe is confidential;

(iv) any information shared by each Party in connection with this Agreement, including information relating to its officers, shareholders, ultimate beneficial owner, financials, business or operations; and

(v) any information shared by each Party in connection with this Agreement, including information relating to its officers, shareholders and/or ultimate beneficial owner.

(f) Borrowers means Leads whom have applied for Financing from Funding Societies (specifically Funding Societies Pte Ltd) and has been approved by Funding Societies (specifically Funding Societies Pte Ltd) to obtain the financing subject to terms as prescribed by Funding Societies (specifically Funding Societies Pte Ltd).

(g) Loss means any and all losses, damages, expenses, costs (including legal costs to lawyers and losses, damages, expenses and costs arising out of claims or proceedings).

(h) Platform means Funding Societies' platform which is used, owned, managed and operated to market its services which is accessible and found in www.fundingsocieties.com (including its changes or modifications from time to time) in all versions namely, without limitation, iOS and android versions.

(i) Referral Partner means any person, entity or individual which intends to refer prospective Borrower(s) to Funding Societies via the Platform for the purpose of applying for a loan or financing and, for that purpose it is bound by the provisions of the Agreement;

(i) SME Referral Programme refers to the arrangement where Referral Partner may refer a Borrower(s) to Funding Societies, based on the terms and conditions of this Agreement;

(j) Term shall have the meaning as set out in Clause 8.1;

1.2 In this Agreement, the following also apply:

(a) 'Person', also mean that person's executors, personal representatives and anyone authorised to take over their legal rights. 'Person' also includes an individual, a partnership, a corporate organisation, an unincorporated association, a government, a state, an agency of state and a trust.

(b) 'Including' means 'including without any limitation'.

(c) A 'regulation' includes any regulation, rule, official directive, request, code of practice or guideline (whether or not having the force of law) of any government organisation, agency, department, taxing authority or other authority or organisation in any jurisdiction.

(d) Whenever referring to a law or regulation, also includes any amendments to it and related legislation.

(e) Any agreement or document includes any amendment, supplement, or replacement to that agreement or document.

2. REFERRAL ARRANGEMENT AND FEE

2.1 During the Term, it is agreed that the Referral Partner shall refer Leads to Funding Societies that fulfil the criteria set out in Schedule 2, in accordance with the provision of this Agreement and the specific guidelines set out in Schedule 1 (“Referral Arrangement”).

2.2 The Referral Partner shall, in doing the Referral Arrangement, only provide relevant information as given to it by Funding Societies to the Leads. For the sake of clarity, the Referral Partner shall not be providing any financial advice to such Lead and merely share Funding Societies’ approved information with them and eligibility for any Financing shall be determined solely by Funding Societies.

2.3 For each Lead to be referred, the Referral Partner shall provide Funding Societies with the contact information and documentation needed to follow-up with such Lead, as specified in Schedule 3. Prior to providing Funding Societies any referral, the Referral Partner shall obtain prior approval of the Leads whose relevant information related to them are to be provided to Funding Societies, if so required to comply with existing regulations, agreements or commitments made or entered into by and between the Referral Partner and the Leads.

2.4 Both Parties shall comply and remain in compliance with the Personal Data Protection Act 2012 (PDPA) as current and in effect at the applicable time, including any mandatory provisions on confidentiality or information disclosure (if any).

2.5 Each Party shall release, defend and indemnify each other against all losses, expenses and liabilities which may arise from or in connection with its failure to comply with Clause 2.4 above (if so required).

2.6 The Referral Arrangement would be applicable to Funding Societies’ operations in Singapore.

2.7 Subject to the Referral Partner’s continued compliance with the terms and conditions of this Agreement, where Funding Societies successfully enters into a financing arrangement with any Leads pursuant to the referral given by the Referral Partner, then Funding Societies shall pay a referral fee to the Referral Partner in accordance with the referral fee payment terms and details as set out Schedule 4 or such other fee as may be otherwise agreed in writing between both Parties (“Referral Fee”). The payment of the Referral Fee shall be made to the bank account of the Referral Partner as stipulated in Schedule 5.

2.8 Any bank and transaction fee (Transaction Fees) incurred for or in connection with the transfer of the Referral Fee from Funding Societies to the Referral Partner will be deducted by Funding Societies from the Referral Fee. In the event when the Transaction Fees are estimated to be higher than the Referral Fee, Funding Societies will inform the Referral Partner by email within five (5) business days without having to compensate the Referral Partner nor provide any reimbursement in relation to any deficit, loss or detrimental consequences resulting from a higher amount of the Transaction Fees than the Referral Fee.

2.9 Funding Societies will not be responsible for any foreign exchange costs, fees, expenses and losses arising from any currency conversion between the Referral Fee which is paid in Singapore Dollars and the Referral Partner’s bank account.

3. DISCLOSURE

3.1 In carrying out the Referral Arrangement, the Referral Partner is prohibited from giving advices, inputs or rendering recommendations, directions or suggestions on any investment products, marketing or promoting any investment schemes or carrying out any initiatives or activities which would therefore jeopardize violate any prevailing laws and/or regulations, decrees, rulings or policies of any government institutions including verdicts or awards of any judicial or arbitral bodies or result in any infringement of any third party’s rights.(b) clarity as to whether the Referral Partner is or will be remunerated for carrying out its obligations set out hereunder and the amount of the said remuneration (if any) if so requested by the prospective Borrowers.

4. CONFIDENTIALITY

4.1 The Referral Partner shall not, at any time, use the Confidential Information arising from this Agreement for any other purpose except for the purpose of carrying out the obligations under this Agreement. The Referral Partner shall keep the Confidential Information confidential and not disclose it to anyone except as provided by Clause 4.2 and shall ensure that the Confidential Information is protected with security measures and a degree of care that would apply to each Party’s own confidential information and in any case not less than reasonable care.

4.2 The Referral Partner may disclose Confidential Information:

(a) to directors and employees on a strictly need-to-know basis, to the minimum extent necessary, and on condition that the recipient is bound by confidentiality requirements and agree to be responsible for the breach by any such recipient;

(b) where required by applicable law or to any competent governmental or statutory authority provided that, to the extent legally permitted, each Party provide the other with notification of the full circumstances of the requirement before any proposed disclosure; and/or

(c) with Funding Societies’ prior written consent.

4.3 The Referral Partner agrees to notify Funding Societies immediately upon becoming aware that Confidential Information has been used or disclosed in breach of this Agreement.

4.4 Upon termination or expiration of this Agreement, each Party shall use its best endeavours to:

(a) return or destroy all Confidential Information;

(b) destroy or permanently erase all copies of Confidential Information made; and

(c) ensure that anyone who has received any Confidential Information destroys or permanently erases such Confidential Information and all copies made by them.

4.5 Confidential Information shall not include any information which becomes generally known to the public other than as a direct or indirect result of any default, wilful or negligent act or omission.

4.6 This Clause 4 shall survive the termination or expiration of this Agreement.

5. REPRESENTATIONS, WARRANTIES AND UNDERTAKINGS

5.1 Each of the Parties hereby warrants and represents to the other Parties:

(a) that such Party has full power, capacity and authority to enter into and execute this Agreement and all documents or instruments to be executed by such Party pursuant to this Agreement and to carry the terms hereof and thereof into effect and deliver and perform all of its obligations under this Agreement and any other agreements contemplated hereunder;

(b) that such Party has all authorisations, licences or approvals to conduct its principal business activities;

(c) that this Agreement constitutes legal, valid and binding obligations of such Party in accordance with their respective terms; and

(d) that the execution, delivery and performance of this Agreement does not violate any law or regulation or any judgment, order or decree of any governmental or regulatory authority, or any contract or undertaking binding on or affecting it.

6. INDEMNITY

6.1 The Referral Partner agrees to indemnify Funding Societies and its Associated Parties against all losses, taxes, expenses, costs, legal fees, and liabilities (present, future, contingent or otherwise on an indemnity basis), which may be suffered or incurred by Funding Societies as a result of or in connection with:

(a) the Referral Partner’s breach of or non-compliance with this Agreement;

(b) any suits, proceedings or claims of third party, bankruptcy, criminal offenses, non-compliance with or violation of any prevailing laws and/or regulations or of any rights of third party or of any decrees or directions of any governmental authorities or judicial bodies committed by or which involve the Referral Partner and/or its Associated Parties; and

(c) and/or any steps taken by Funding Societies in the event of a breach of this Agreement.

6.2 Funding Societies shall not, and the Referral Partner shall ensure that Funding Societies will not be involved, by any means or under any circumstances whatsoever, in any proceeding, investigation, inspection, examination, dispute, negotiation and conflict which arise from or in connection with the matters as referred to Clause 6.1(a) and Clause6.1(b) above unless Funding Societies expressly choose or agree with it.

7. EXCLUSION AND LIMITATION OF LIABILITY

7.1 Each Party shall be solely responsible for its operations in acting under this Agreement, including, without limitation, the legality of the Party’s operations and materials, created and used in connection with this Agreement.

7.2 Neither Funding Societies nor any of its Associated Parties shall be liable in contract, tort (including negligence or breach of statutory duty) or otherwise, for (i) any loss of profit, business or revenue, (ii) any costs or expenses, or any special, indirect or consequential damages of any nature whatsoever, suffered or incurred by the other Party as a result of or in connection with the implementation of this Agreement and/or performance of its rights and obligations set out thereunder.

8. EFFECTIVE DATE AND TERMINATION

8.1 This Agreement shall remain valid for such period of time as Funding Societies prescribed based on its sole discretion Term”).

8.2 Either Party has the option to terminate this Agreement by giving an email notification of thirty (30) calendar days to the other Party.

8.3 Upon termination, all rights and obligations of the Parties under this Agreement shall come to an end, except for those rights or obligations of the Parties which are specified or intended by the Parties to survive termination. Termination of this Agreement does not affect any accrued right or liability of either Party or any other obligation surviving termination or any rights or remedies of any Party under this Agreement or at law.

9. NOTICES

9.1 Any notice, communication or demand in connection with this Agreement shall be in writing and shall be delivered personally, or by hand, post, or electronic mail to the addresses or electronic mail addresses set out in this Agreement or addresses or electronic mail addresses as the recipient may have notified to the other Party hereto in writing:

To Referral Partner :

Postal address: Address as submitted by the User via the Platform

Email address: Email address as submitted by the User via the Platform

Attention: Name as submitted by the User via the Platform

To Company:

Postal address: 112 Robinson Road, #08-01/02/03/04, Singapore 068902

Email address: tamara.lee@fundingsocieties.com

Attention: Tamara Lee, Partnerships Manager, Funding Societies

9.2 Any notice, communication or demand given as provided in this Clause shall be deemed received by the party to whom it is addressed:

(a) if delivered by hand, when so delivered;

(b) if sent by pre-paid post, on the third (3rd) Business Day after posting;

(c) if by electronic mail, on the Business Day of the transmission or the sending of the said electronic e-mail, or on a day which is not a Business Day, it shall be deemed received on the following Business Day.

10. GOODS AND SERVICES TAX

10.1 Where any amount payable under this Agreement are subjected to GST, the Parties shall charge GST at the prevailing rate in addition to the amount payable under this Agreement. The relevant Party shall issue the relevant tax invoice for such GST as soon as reasonably practicable and shall deliver the same to the other Party whereupon the other Party shall pay the relevant amount for such GST within the time stipulated in the tax invoice.

11. AMENDMENT, VARIATION OR CHANGES TO THIS AGREEMENT

11.1 Funding Societies reserve all rights to make any amendment, variation or changes to this Agreement (or of any of the documents referred to in this Agreement including the terms of the SME Referral Programme) without further reference to the Referral Partner.

12. SERVICE OF LEGAL PROCESS

12.1 The service of any legal process pursuant to any rules of court of competent jurisdiction may be given by prepaid registered or ordinary post addressed to the Referral Partner at his address specified herein or at the last known place of business or registered address and such legal process shall be deemed to have been duly served on the third (3rd) Business Day following that on which it is posted, notwithstanding that the said demand or legal process may subsequently be returned undelivered by the postal authorities and if delivered by hand, on the day it was delivered.

12.2 “Legal Process” shall mean all forms of originating process, pleadings, interlocutory applications of whatever nature, affidavits, orders and such documents, other than the aforesaid, which are required to be served under any legislation or subsidiary legislation or by the terms of this Agreement.

12.3 No change in the address for service howsoever brought about shall be effective or binding on Funding Societies unless the Referral Partner has given to Funding Societies actual notice of the change of the address and nothing done in reliance on Clause 9.1 above shall be affected or prejudiced by any subsequent change in the address for which Funding Societies has no actual knowledge of at the time the act or thing was done or carried out.

13. ANTI-MONEY LAUNDERING & PREVENTION OF TERRORIST FINANCING

13.1 For the avoidance of doubt, the Referral Partner acknowledges and agrees that Funding Societies may and without giving prior written notice immediately terminate this Agreement, its account on, and/or access to, the platform and/or cease providing any of its arrangement set forth in this Agreement, where Adverse Information is subsequently discovered in the course of completing the performance of due diligence measures on the Referral Partner in the performance of its referral activities or obligations under this Referral Arrangement.

13.2 “Adverse Information” means any information that may give Funding Societies reasonable grounds to suspect money laundering or terrorist financing or any illegal activities (according the relevant laws); such potential information may include but is not limited to; evidence of money laundering or terrorist financing on the Referral Partner (i) that is from and/or have business from countries or jurisdictions which have relatively higher levels of corruption, organized crime or inadequate AML/CFT measures, as identified by the Financial Action Task Force (FATF) or Transparency International; (ii) from higher risk businesses / activities / sectors identified in Singapore’s National Risk Assessment (NRA); (iii) where the ownership structure of the legal person or arrangement appears unusual, suspicious or excessively complex given the nature of the legal person or legal arrangement’s business; and/or (iv) that have nominee shareholders or shares in bearer form.

14. MEDIA COVERAGE OF PARTNERSHIP

14.1 It is hereby acknowledged by the Parties that Funding Societies may from time to time provide media coverage and communication of the partnership on its platform to its investor and issuer/borrower base.

15. GENERAL

15.1 This Agreement constitutes the entire agreement of the Parties relating to the provisions set out in this Agreement. This Agreement supersedes all prior communications, contracts, or agreements, written or oral, agreements between the Parties with respect to any provisions set out in this Agreement.

15.2 This Agreement shall not be interpreted or construed as to create any association or partnership between the Parties hereto for any activities outside the scope of agreement described in it. The Parties hereto remain independent contractors and continue to have the right to carry on their individual business for their own benefit.

15.3 Any term, condition, stipulation, provision, covenant or undertaking contained herein which is illegal, void, prohibited or unenforceable in any jurisdiction shall, as to such jurisdiction, be ineffective to the extent of such illegality, prohibition or unenforceability without invalidating the remaining provisions hereof and any such illegality, prohibition or unenforceability in any jurisdiction shall not invalidate or render illegal, void or unenforceable any such term, condition, stipulation or undertaking in any other jurisdiction.

15.4 Any liability to any Party hereto may in whole or in part be released, compounded or compromised or time or indulgence given by that Party in that Party’s absolute discretion as regards any other Party hereto under such liability without in any way prejudicing or affecting:

(a) the first Party’s rights against any other Party or Parties hereto under the same or a like liability whether joint or several or otherwise; and

(b) any other rights of the first Party against the other Party or Parties in connection with its obligations under this Agreement.

15.5 No remedy conferred by any of the provisions of this Agreement is intended to be exclusive of any other remedy which is otherwise available at law, in equity, by statute or otherwise, and each and every other remedy shall be cumulative and shall be in addition to every other remedy given hereunder or now or hereafter existing at law, in equity, by statute or otherwise. The election of any one or more of such remedies by any of the Parties hereto shall not constitute a waiver by such Party of the right to pursue any other available remedies.

15.6 This Agreement may be executed in any number of counterparts and by the Parties on separate counterparts, each of which when so executed shall be an original, but all counterparts shall together constitute the same document.

15.7 In this Agreement, any reference to any legal entity or individual person includes, where appropriate, a reference to its authorised agents, delegates, successors or nominees. Expressions in the singular form include the plural and vice versa.

15.8 The headings used in this Agreement are for convenience of reference only and are not to affect the construction of, or to be taken into consideration in, interpreting this Agreement.

15.9 This Agreement shall be binding upon the successors-in-title of the Referral Partner and on the successors-in-title and assignees of Funding Societies

15.10 Time shall be the essence of this Agreement.

16. GOVERNING LAW AND JURISDICTION

16.1 This Agreement shall be governed by and shall be construed in all respects in accordance with the laws of Singapore and in relation to any legal action or proceedings arising out of or in connection with this Agreement (“Proceedings”) and the parties herein hereby submit to the non-exclusive jurisdiction of the courts of Singapore and waives any objections to proceedings in any court on the grounds that the Proceedings have been brought in an inconvenient forum.

16.2 Such submission however shall not affect the right of Funding Societies to take Proceedings in any other jurisdiction (where necessary) nor shall the taking of Proceedings in any jurisdiction preclude Funding Societies from taking Proceedings in any other jurisdiction and Funding Societies shall be at liberty to initiate and take actions or Proceedings or otherwise in the court of Singapore and/or elsewhere as it may deem fit.

IN WITNESS WHEREOF the Parties have executed this Agreement, with immediate binding effect on the Parties, when the Referral Partner render its consent on the Consent Date as recorded by Funding Societies.

Schedule 1: GUIDELINES ON REFERRAL ACTIVITY

This document is a guideline applicable to all partners of Funding Asia Group Pte. Ltd. (Company Registration No. 201537647E) (“Funding Societies”) who undertake referral activity for the benefit of Funding Societies (“Referral Partner”).

This guideline applies also to the Referral Partner’s employees, agents, representatives or any other persons who acts on the Referral Partner’s behalf of (“Agents”) or such purpose. Failure of the Referral Partner or its Agents to comply with these Guideline shall be deemed as an event of default by the Referral Partner under the contractual arrangement between the Referral Partner and Funding Societies.

Who can the Referral Partner refer to Funding Societies?

The Referral Partner may only refer clients within the Referral Partner’s existing network or clients which the Referral Partner already has a pre-existing relationship with prior to conducting any referral activity.

What are the do’s and don’ts in conducting referral activities?

Do’s:

Referral Partner shall only share or display information or material concerning Funding Societies which have been fully reviewed and approved by Funding Societies and in the specific manner as required by Funding Societies

Only when the potential client has indicated a clear interest to inquire further or to apply for financing with Funding Societies, and have given consent to the Referral Partners, can the Referral Partner refer such client to Funding Societies.

Don’ts:

Strictly no cold calling, active marketing or solicitation of Funding Societies’ products and services on behalf of Funding Societies without consent.

Strictly no representation of any facts or answering of any queries on behalf of Funding Societies including the financing options available or product information offered by Funding Societies. (All such queries shall be directed to Funding Societies to respond directly to the potential clients.

Modes of Referral:

Ad-hoc basis

Referral Partners may, on an ad hoc basis, on its own initiative or upon request of a member in its network, inform its network of financing opportunities offered by Funding Societies. The Referral Partner shall, upon receiving consent from the potential client, forward their contact details directly to Funding Societies via message or email or provide such potential client Funding Societies’ contact details for them to contact Funding Societies directly (depending on potential client’s preference). Funding Societies will thereafter follow up with the potential client.

Landing page on Referral Partner’s platform or website

The Referral Partner may have a designated landing page allowing clients within its network to submit basic information for the purpose of onward referral by the Referral Partner to Funding Societies. The landing page may only contain specific descriptions of Funding Societies’ financing solutions as approved by Funding Societies.

Electronic Direct Mail (“EDM”)

Referral Partners may issue an EDM to its network, where such EDM is provided by or fully reviewed and approved by FSPL. The EDM shall include a click-through link where potential clients who, on its own volition, clicks on such link may be directed to a designated landing page on Funding Societies’ website allowing such the potential client the option to complete an online application form should they be interested in applying for financing.

1. Singapore registered company

2. 30% local shareholding

3. History of bankruptcy to be settled for more than 24 months while history of adverse litigation to be settled for more than 12 months (at a minimum, self-declared)

Schedule 2: REFERRAL CRITERIA

SME Qualifying Criteria

Singapore registered company

30% local shareholding

History of bankruptcy to be settled for more than 24 months while history of adverse litigation to be settled for more than 12 months (at a minimum, self-declared)

Blacklist / Exclusions:

Money lender

Currency, Commodities & precious metal (all types) traders

MLM / Pyramid scheme companies

Investment holding companies

Real estate investment, Financial institutions & Investment fund companies

Shell companies

Schedule 3: SUPPORTING DOCUMENTATION

Documentation requirements

The Referral Partner shall assist Funding Societies by providing sufficient information and documentation on the Lead (provided that such Lead has granted the Partner consent to do so) to enable Funding Societies to follow up with such Lead on its own. Full collection and verification of documentation and information shall be done by Funding Societies.

Notes:

Referral fee is expressed a percentage of the amount disbursed.

Referral fee will only be payable to Referral Partner if the information requirements (per Schedule 2) have been fulfilled by the Referral Partner to the satisfaction of Funding Societies, and if the loan is disbursed to the Borrower(s) within one (1) month of the provision of the Requested Information by the Referral Partner.

Referral fee would be payable by Funding Societies to Referral Partner within two (2) months after approval of financing and disbursement for the referred Borrower.

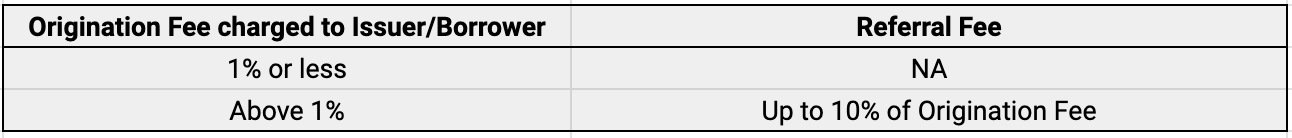

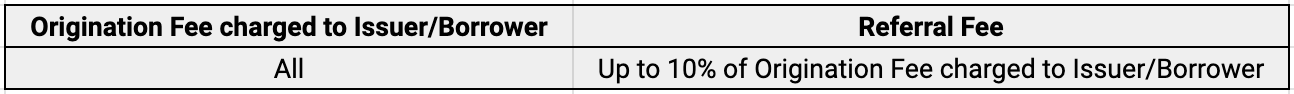

Schedule 4: REFERRAL FEE

SECURITY PROPERTY-BACKED LOANS

BOLT, BUSINESS TERM LOAN, ACCOUNTS PAYABLE, ACCOUNTS RECEIVABLE

Notes:

Referral fee is expressed as a percentage of the Origination Fee charged to the Issuer/Borrower. For the avoidance of doubt, ‘Origination Fee’ refers to the fee charged on the entire line facility limit (for line facility) and/or utilised amount (for non-line facility) in the respective facility taken by the Issuer/Borrower.

If any Borrower referred by Partner has previously submitted an application for financing to Funding Societies, Funding Societies will be responsible for alerting and providing the necessary evidence to Partner within 5 business days of the referral being made.

The referral shall only be deemed to be successful upon disbursement to the Issuer/Borrower.

The Referral Fee shall be paid on a monthly basis wherein:

Should the Referral Partner be a GST registered entity, Funding Societies shall by 5th day of each calendar month provide the Referral Partner a summary of all successful referral which has occurred in the previous calendar month and the Referral Partner shall forthwith issue an invoice to Funding Societies for the Referral Fee payable (in any case no later than the 10th day of such calendar month). Funding Societies shall accordingly make payment within one (1) month from the receipt of the invoice from the Referral Partner.

Should the Referral Partner not be a GST registered entity, Funding Societies shall accordingly make payment of Referral Fee for all successful referral which has occurred in the previous calendar month by the last day of the following calendar month.

Schedule 4: Referral Fee Payment Details

Funding Societies will contact the Referral Partner at the email address submitted via the Platform to gather the details below.

Bank name

Account name

Account number

GST Registration No

Indonesia

Pendana

layanan@modalku.co.id

+62 877 3751 1114

Peminjam

info@modalku.co.id

+62 877 7873 6144

Penagihan

collection-id@modalku.co.id

Unifam Tower, Jl. Panjang Raya

Blok A3 No.1, Kedoya Utara,

Kebon Jeruk, Jakarta Barat,

DKI Jakarta, 11520, Indonesia

Singapore

info@fundingsocieties.com

General Enquiries:

+65 6221 0958

Sales Enquiries:

+65 6011 7534

108 Robinson Road

#06-01

Singapore 068900

Malaysia

info@fundingsocieties.com.my

Primary contact

+603 9212 0208

Secondary contact

+603 2202 1013

Unit 15.01 & Unit 15.02,

Level 15, Mercu 3,

KL Eco City, Jalan Bangsar,

59200 Kuala Lumpur

Thailand

SME Loan

info@fundingsocieties.co.th

+66 93 139 9721

Investment

invest@fundingsocieties.co.th

+66 62 197 8661

No. 29, Vanissa Building,

24th Floor, Room No. 2412 & 2414,

Soi Chidlom, Ploenchit Road,

Lumpini, Pathumwan,

Bangkok, 10330

Vietnam

info@fundingsocieties.vn

(+84) 28 7109 7896

The Sarus Building

67 Nguyen Thi Minh Khai

Ben Thanh Ward, District 1

Ho Chi Minh City, Vietnam

Dreamplex

174 Thai Ha Street,

Trung Liet Ward, Dong Da District,

Hanoi, Vietnam

Funding Societies is Southeast Asia's leading SME digital financing platform. We specialise in all forms of short-term financing for SMEs, funded by individual and institutional investors. We pride ourselves in speed and flexibility, offering the widest range of term loan, trade finance and micro loan products. Backed by SoftBank Ventures Asia Corp and Sequoia India, amongst many others, Funding Societies has helped to finance over S$2 billion in business loans regionally. We are dedicated to the vision of enabling SMEs through equitable financial access, ultimately making a positive impact for our societies in Southeast Asia.

Funding Societies Pte. Ltd. and FS Capital Pte. Ltd. are part of the Funding Societies Brand.

Funding Societies Pte. Ltd.

Business Registration No.: 201505169M | CMS License No.: CMS100572

FS Capital Pte. Ltd.

Business Registration No.: 201631787R

© 2023 Funding Societies Pte. Ltd. & FS Capital Pte. Ltd. All rights reserved.